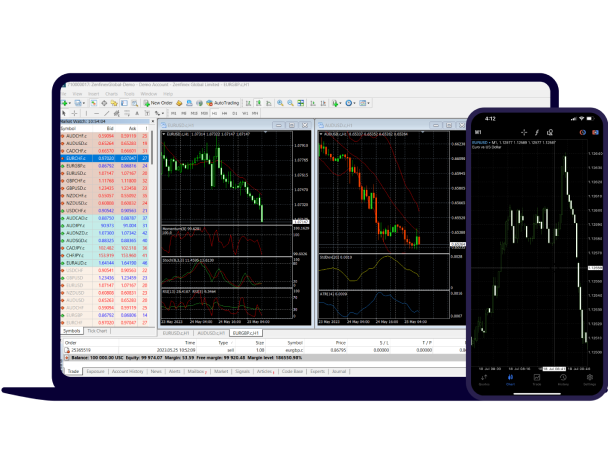

Multiple Platforms

Experience seamless forex trading with our native Tradeca App, along with the MT5 platforms, accessible on web, and mobile. Tailor your trading journey with robust charting tools, technical indicators, and one-click trading.

Get started