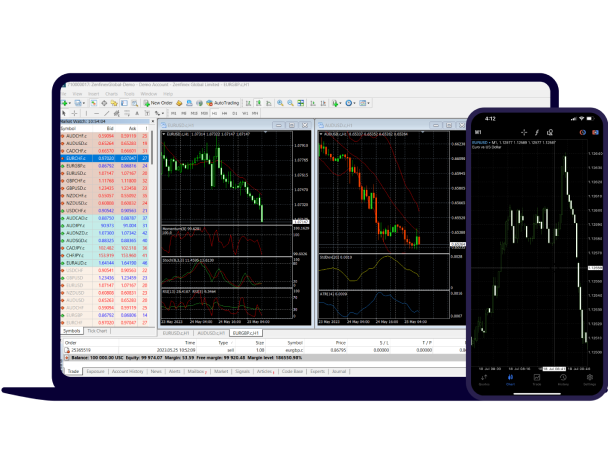

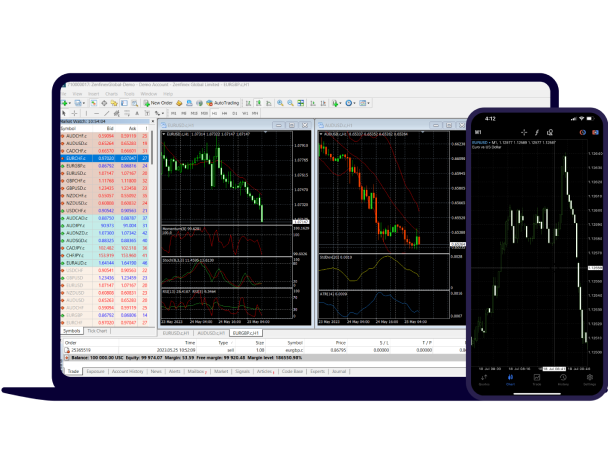

Cross-Device Trading

Master your Share CFDs trading with MT5, the powerhouse platform available on all devices. Chart with precision, leverage advanced indicators, and execute trades efficiently, wherever you are.

Get started

Trade share CFDs with fast execution on the top and most

popular companies from leading

stock exchanges

Check out the current bulls, bears, and trending price movements

All account types

| Symbol | Commission | Margin Req % | Leverage | Trading Hours |

|---|---|---|---|---|

| AC.FR | 0 | 1:20 | 10:01 - 18:30 | |

| ACA.FR | 0 | 1:20 | 10:01 - 18:30 | |

| ADP.FR | 0 | 1:20 | 10:01 - 18:30 | |

| AF.FR | 0 | 1:20 | 10:01 - 18:30 | |

| AI.FR | 0 | 1:20 | 10:01 - 18:30 | |

| AIR.FR | 0 | 1:20 | 10:01 - 18:30 | |

| AKE.FR | 0 | 1:20 | 10:01 - 18:30 | |

| ALO.FR | 0 | 1:20 | 10:01 - 18:30 | |

| AMUN.FR | 0 | 1:20 | 10:01 - 18:30 | |

| ATO.FR | 0 | 1:20 | 10:01 - 18:30 | |

| BB.FR | 0 | 1:20 | 10:01 - 18:30 | |

| BIM.FR | 0 | 1:20 | 10:01 - 18:30 | |

| BN.FR | 0 | 1:20 | 10:01 - 18:30 | |

| BNP.FR | 0 | 1:20 | 10:01 - 18:30 | |

| BOL.FR | 0 | 1:20 | 10:01 - 18:30 | |

| CA.FR | 0 | 1:20 | 10:01 - 18:30 | |

| CAP.FR | 0 | 1:20 | 10:01 - 18:30 | |

| CDI.FR | 0 | 1:20 | 10:01 - 18:30 | |

| CGG.FR | 0 | 1:20 | 10:01 - 18:30 | |

| CO.FR | 0 | 1:20 | 10:01 - 18:30 |

Master your Share CFDs trading with MT5, the powerhouse platform available on all devices. Chart with precision, leverage advanced indicators, and execute trades efficiently, wherever you are.

Get started

Find answers to commonly asked questions about share CFD trading on Tradeca FX, including topics related to account setup, platform features, trading conditions, and more

Get more answersStock/share CFDs are derivative instruments that allow traders to speculate on the price movements of individual company stocks without owning the underlying shares. CFDs replicate the price performance of the underlying stocks, providing traders with the opportunity to profit from both rising and falling markets. It's crucial to have a clear understanding of the risks involved and to implement proper risk management strategies, such as setting stop-loss orders and using appropriate position sizing.

Spreads refer to the tight bid/ask spreads available for trading CFDs on stocks with Tradeca FX. These spreads represent the difference between the buying and selling price of a CFD. Tight spreads can be advantageous for traders as they minimize trading costs. With our tight spreads, traders can enter and exit positions with greater efficiency and potentially capture more favorable price movements.

Tradeca FX may apply overnight financing charges, also known as swap rates or rollover fees, for holding stock CFD positions overnight. These charges are associated with the cost of maintaining a leveraged position beyond the daily market close. The rates can vary based on the underlying stock, prevailing interest rates, and market conditions. You should review our Pricing page to get a better understanding of any swaps that may apply.

Yes, one of the significant benefits of CFD trading is the ability to go short on Share CFDs. Going short means, you can profit from price declines by selling a CFD contract without owning the underlying shares. However, it's important to note that CFD trading, including going short, carries certain risks. The value of Share CFDs can fluctuate rapidly, and if the price goes against your position, you may incur losses.

Yes, Tradeca FX typically supports various order types for trading stock CFDs. This includes market orders, limit orders, and stop orders. Market orders are executed at the current market price, limit orders allow you to set specific entry or exit prices for your trades, and stop orders are used to trigger a trade once the price reaches a specified level.